1. Introduction to Earned Value Management

Construction projects fail more often due to poor cost and schedule visibility than due to technical engineering issues. Traditional tracking methods—such as comparing planned budgets to actual spending—only answer half the question. A project may be under budget but behind schedule, or overspending while appearing productive. This blind spot is where Earned Value Management (EVM) becomes essential.

Earned Value Management in construction is a performance measurement system that integrates scope, cost, and schedule into a single, objective framework. Instead of asking “How much have we spent?”, EVM asks a more powerful question:

“How much value has the project actually earned for the money spent?”

This distinction transforms project control from reactive reporting into predictive decision-making. With EVM, project managers can forecast final costs, predict schedule overruns months in advance, and take corrective action before delays become claims and disputes.

In large infrastructure, EPC, and industrial projects, EVM is no longer optional. It is mandated by owners, government agencies, and lenders because it provides quantifiable, auditable performance data. When implemented correctly, EVM becomes a single source of truth for project health.

This masterclass explains Earned Value Management from the ground up, specifically for construction professionals—project managers, planners, quantity surveyors, cost engineers, and contract administrators. Every concept is tied to real construction scenarios, with formulas, worked examples, and practical checklists.

By the end of this guide, your project team will be able to:

- Measure real progress objectively

- Detect cost and schedule risks early

- Forecast final outcomes with confidence

- Communicate performance clearly to stakeholders

Table of Contents

2. Why Earned Value Management Matters in Construction

Construction projects are uniquely complex. Unlike manufacturing or IT projects, construction involves physical progress, site constraints, subcontractor dependencies, and external risks such as weather, approvals, and supply chain disruptions. These realities make traditional cost tracking insufficient.

2.1 The Limitations of Traditional Project Tracking

Most construction teams rely on:

- Budget vs actual cost reports

- Schedule updates showing planned vs actual dates

- Percent-complete estimates based on judgment

These methods suffer from three major flaws:

- They are subjective

Percent complete is often estimated without measurable criteria. - They are backward-looking

They explain what happened, not what will happen. - They separate cost and schedule

A project can appear “on budget” while being months behind.

Earned Value Management solves all three problems by linking cost to physical progress.

2.2 Cost Overruns and Schedule Delays: The Industry Reality

Studies consistently show that:

- Over 70% of large construction projects exceed their budgets [1]

- Average schedule overruns range from 20% to 45% in infrastructure projects [2]

- Early warning signs typically appear within the first 20–30% of project duration, but are often ignored

EVM addresses this by providing leading indicators, not lagging reports.

2.3 Owner and Contractor Benefits of EVM

For Owners:

- Transparent project performance

- Early identification of troubled contracts

- Better cash flow forecasting

- Reduced claims and disputes

For Contractors:

- Improved margin protection

- Better subcontractor performance tracking

- Stronger delay and disruption claims support

- Data-driven decision-making

EVM is not just a reporting tool—it is a risk management system.

2.4 Regulatory and Contractual Importance

In many countries, EVM is:

- Required in government-funded infrastructure projects

- Mandated in EPC and PMC contracts

- Used by lenders for project finance monitoring

Understanding EVM is now a career-critical skill for construction professionals.

🔗 Learn how EVM integrates with planning in [Construction Planning and Scheduling Fundamentals – Famcod]

3. History and Evolution of Earned Value Management

3.1 Origins in Defense and Aerospace

Earned Value Management originated in the US Department of Defense in the 1960s. Complex defense programs required a method to:

- Track thousands of activities

- Control massive budgets

- Detect problems early

The result was Cost/Schedule Control Systems Criteria (C/SCSC), the precursor to modern EVM.

3.2 Adoption in Construction and Infrastructure

As construction projects grew in size and complexity, EVM transitioned into:

- Oil & gas megaprojects

- Power plants

- Rail and highway infrastructure

- Industrial EPC contracts

Modern EVM standards are now governed by:

- ANSI/EIA-748

- PMI’s PMBOK Guide

- ISO 21508

3.3 EVM Today: From Compliance to Competitive Advantage

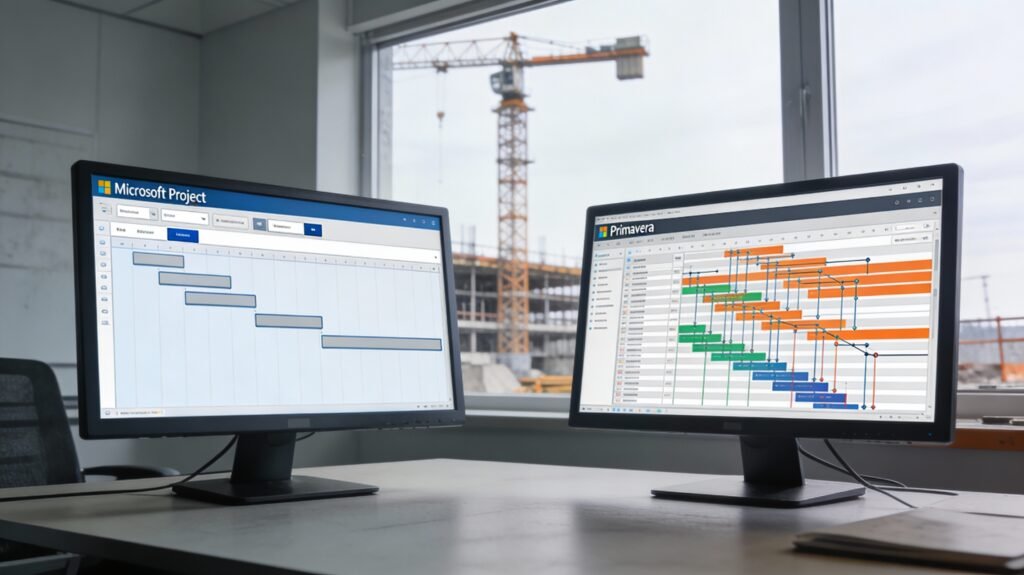

Today, leading construction firms use EVM not as a compliance exercise but as a strategic advantage. Integrated with:

- Primavera P6

- ERP systems

- BIM 4D/5D models

EVM enables real-time project intelligence.

4. Fundamental Concepts of Earned Value Management

At its core, Earned Value Management answers three fundamental questions:

- What was planned?

- What has been accomplished?

- What did it cost?

These questions translate into three foundational metrics.

4.1 Planned Value (PV)

Planned Value (PV) represents the authorized budget assigned to scheduled work at a given point in time.

- Also known as BCWS (Budgeted Cost of Work Scheduled)

- Derived from the approved project baseline

PV=Budgeted cost of work planned up to a date

4.2 Earned Value (EV)

Earned Value (EV) measures the budgeted value of work actually completed.

- Also known as BCWP (Budgeted Cost of Work Performed)

- Tied to physical progress, not cost

EV=Budgeted cost of completed work

4.3 Actual Cost (AC)

Actual Cost (AC) is the actual expenditure incurred for the work performed.

- Also known as ACWP

- Taken from accounting records

AC=Actual cost incurred to date

4.4 Why These Three Values Matter Together

Individually, PV, EV, and AC provide limited insight. Together, they enable:

- Cost variance analysis

- Schedule variance analysis

- Performance forecasting

Key Rule:

Earned Value uses budgeted cost to measure performance—not actual cost.

5. Core EVM Metrics and Terminology

5.1 Cost Variance (CV)

CV=EV−AC

- Positive CV → under budget

- Negative CV → over budget

5.2 Schedule Variance (SV)

SV=EV−PV

- Positive SV → ahead of schedule

- Negative SV → behind schedule

5.3 Cost Performance Index (CPI)

CPI=ACEV

- CPI > 1.0 → cost efficient

- CPI < 1.0 → cost overrun

5.4 Schedule Performance Index (SPI)

SPI=PVEV

- SPI > 1.0 → ahead of schedule

- SPI < 1.0 → schedule slippage

These indices are predictive, not just descriptive.

6. The EVM Baseline: Cost, Schedule, and Scope Integration

6.1 Work Breakdown Structure (WBS)

EVM requires a well-defined WBS, linking:

- Scope elements

- Activities

- Budgets

- Responsibility

6.2 Control Accounts and Work Packages

Each control account includes:

- Defined scope

- Time-phased budget

- Measurement criteria

6.3 Progress Measurement Methods

Common methods include:

- 0/100 rule

- 50/50 rule

- Milestone weighting

- Physical measurement

Correct selection is critical for accurate EV calculation.

🔗 Internal reference: See Work Breakdown Structure Best Practices – Famcod [memory:2]

Practical Earned Value Management Methodologies in Construction

7. Step-by-Step Implementation of Earned Value Management in Construction Projects

Implementing Earned Value Management in construction is not about adding more reports—it is about structuring the project correctly from day one. When EVM fails, it is almost always due to poor setup, not the formulas.

7.1 Step 1: Develop a Robust Work Breakdown Structure (WBS)

A construction-ready WBS must:

- Reflect physical scope, not accounting codes

- Be measurable on site

- Align with BOQ, drawings, and schedule

Best Practice WBS Levels:

- Project

- Discipline (Civil, Structural, MEP)

- System (Foundations, Superstructure, Finishes)

- Work Package (Footings, Columns, Slabs)

Checklist – WBS Validation

- ☐ Each work package has clear start & finish

- ☐ Progress can be physically verified on site

- ☐ Budget can be assigned without assumptions

- ☐ Responsibility is clearly defined

🔗 Internal reference: How to Create a Construction WBS – Famcod [memory:3]

7.2 Step 2: Establish the Cost and Schedule Baseline

The Performance Measurement Baseline (PMB) integrates:

- Approved schedule

- Approved budget

- Defined scope

Time-Phased Budgeting

Budgets must be distributed across time, aligned with the schedule.PV(t)=∑Budgeted cost of activities planned by time t

Without time-phasing, Schedule Performance Index (SPI) becomes meaningless.

7.3 Step 3: Select Progress Measurement Techniques

Different construction activities require different progress rules.

| Activity Type | Recommended Method |

|---|---|

| Earthworks | Physical measurement (m³) |

| Concrete works | Quantity-based progress |

| Equipment installation | Milestone weighting |

| Design packages | 50/50 or milestone-based |

| Commissioning | 0/100 rule |

Rule: Never use % complete without objective measurement criteria.

7.4 Step 4: Capture Actual Costs Accurately

Actual Cost (AC) must include:

- Labor

- Materials

- Equipment

- Subcontractor invoices

- Site overheads

Common Pitfall:

Delaying cost capture by one or two months destroys forecasting accuracy.

7.5 Step 5: Calculate Earned Value and Analyze Performance

At each reporting cycle:

- Measure physical progress

- Calculate EV

- Compare EV with PV and AC

- Analyze variances

- Forecast final outcomes

8. Worked Example 1: Basic Earned Value Calculation (Construction Scenario)

Project Scenario

- Activity: RCC slab casting

- Total budget (BAC): ₹10,00,000

- Planned duration: 10 weeks

- Planned progress by Week 5: 50%

- Actual progress achieved: 40%

- Actual cost incurred: ₹4,80,000

Step-by-Step Calculation

Planned Value (PV)

PV=50%×10,00,000=₹5,00,000

Earned Value (EV)

EV=40%×10,00,000=₹4,00,000

Actual Cost (AC)

AC=₹4,80,000

Performance Analysis

Cost Variance (CV)

CV=EV−AC=4,00,000−4,80,000=−₹80,000

➡ Over budget

Schedule Variance (SV)

SV=EV−PV=4,00,000−5,00,000=−₹1,00,000

➡ Behind schedule

Cost Performance Index (CPI)

CPI=ACEV=4,80,0004,00,000=0.83

Schedule Performance Index (SPI)

SPI=PVEV=5,00,0004,00,000=0.80

Interpretation:

The project is both behind schedule and over budget, requiring immediate corrective action.

9. Forecasting with Earned Value Management

Forecasting is where EVM delivers its greatest value.

9.1 Estimate at Completion (EAC)

EAC predicts the final project cost.

Most Common Formula

EAC=CPIBAC

Using the previous example:EAC=0.8310,00,000=₹12,04,819

➡ Expected overrun: ₹2,04,819

9.2 Estimate to Complete (ETC)

ETC=EAC−ACETC=12,04,819−4,80,000=₹7,24,819

9.3 Time Forecasting Using SPI

Forecast Duration=SPIPlanned Duration=0.8010=12.5 weeks

➡ Expected delay: 2.5 weeks

10. Worked Example 2: Multi-Activity Construction Package

Project Package: Structural Works

| Activity | BAC (₹) | Planned % | Actual % | AC (₹) |

|---|---|---|---|---|

| Footings | 8,00,000 | 100% | 100% | 7,50,000 |

| Columns | 6,00,000 | 80% | 70% | 4,80,000 |

| Slabs | 10,00,000 | 50% | 40% | 4,80,000 |

Step 1: Calculate EV per Activity

- Footings EV = 100% × 8,00,000 = ₹8,00,000

- Columns EV = 70% × 6,00,000 = ₹4,20,000

- Slabs EV = 40% × 10,00,000 = ₹4,00,000

Total EV = ₹16,20,000

Step 2: Calculate PV

- Footings PV = 100% × 8,00,000 = ₹8,00,000

- Columns PV = 80% × 6,00,000 = ₹4,80,000

- Slabs PV = 50% × 10,00,000 = ₹5,00,000

Total PV = ₹17,80,000

Step 3: Calculate AC

Total AC = ₹17,10,000

Step 4: Performance Indices

CPI=17,10,00016,20,000=0.95SPI=17,80,00016,20,000=0.91

➡ Early warning of schedule slippage and emerging cost risk

11. Comparison: Earned Value vs Traditional Construction Tracking

| Aspect | Traditional Tracking | Earned Value Management |

|---|---|---|

| Cost Control | Budget vs Actual | Value vs Cost |

| Schedule Control | Planned vs Actual Dates | Value vs Time |

| Forecasting | Reactive | Predictive |

| Objectivity | Subjective % complete | Measurable progress |

| Claims Support | Weak | Strong |

| Decision Timing | Late | Early |

Conclusion:

EVM provides actionable intelligence, not just reports.

12. Construction-Specific EVM Best Practices

12.1 Align EVM with BOQ and Billing

Earned Value must not be confused with:

- RA bill values

- Cash flow receipts

EV measures earned scope, not paid amounts.

12.2 Reporting Frequency

| Project Size | Reporting Cycle |

|---|---|

| Small projects | Monthly |

| Medium projects | Bi-weekly |

| Mega projects | Weekly |

12.3 Thresholds for Action

Set management thresholds:

- CPI < 0.95 → Cost recovery plan

- SPI < 0.90 → Schedule acceleration

12.4 EVM Integration with Planning Tools

EVM works best when integrated with:

- Primavera P6 schedules

- ERP cost systems

- Site progress tracking

🔗 Internal reference: Construction Cost Control Techniques – Famcod

Advanced Earned Value Management Applications, Tools, and Case Studies

13. Advanced Applications of Earned Value Management in Construction

Once Earned Value Management in construction is implemented correctly, it becomes much more than a reporting mechanism. Advanced project teams use EVM as a decision-support and risk management system.

13.1 Using EVM for Early Risk Detection

EVM identifies future problems early, often within the first 15–25% of project duration.

Key Early Warning Indicators

- CPI trending below 1.0 for 2–3 consecutive periods

- SPI steadily declining even when resources increase

- EV growth slower than physical progress claims

Practical Insight:

Projects that recover after CPI drops below 0.90 are extremely rare without scope or cost intervention [3].

13.2 Earned Value Management for Claims and Dispute Support

EVM provides objective, auditable records that strengthen:

- Extension of Time (EOT) claims

- Prolongation cost claims

- Acceleration claims

- Disruption analysis

How EVM Helps Claims

- Demonstrates planned vs actual performance

- Quantifies productivity loss

- Separates contractor inefficiency from employer delays

EVM data is often accepted by engineers, adjudicators, and arbitrators due to its transparency.

🔗 Internal reference: Construction Claims Management Fundamentals – Famcod [memory:5]

13.3 Cash Flow and Funding Forecasting Using EVM

While EVM is not a cash flow tool, it supports cash forecasting indirectly.

- EV predicts future cost burn

- EAC informs funding requirements

- SPI trends forecast billing delays

Owner Advantage:

Early funding shortfall identification reduces financing risks.

13.4 Integrating EVM with Risk Management

Advanced teams adjust forecasts using risk-adjusted EAC.EACrisk=EAC+Risk contingency

Risk contingency is derived from:

- Known risks

- Productivity trends

- Change order probability

14. Tools and Software for Earned Value Management

Earned Value Management can be implemented using simple tools or enterprise systems. Tool selection depends on project size and maturity.

14.1 Excel-Based EVM (Small to Medium Projects)

Advantages

- Low cost

- High flexibility

- Easy customization

Limitations

- Manual data entry

- Error-prone at scale

- Limited integration

Typical Excel EVM Structure

- WBS sheet

- Budget allocation

- Progress input

- Automated EV calculations

- Dashboard (CPI, SPI trends)

14.2 Primavera P6 and EVM

Primavera P6 is widely used in construction for EVM.

Key Features

- Time-phased budgets

- Resource-loaded schedules

- EV calculation at activity level

- Baseline comparison

Best Practice

- Lock baselines

- Avoid frequent re-baselining

- Validate physical progress inputs

14.3 ERP and Project Controls Systems

Large projects integrate EVM with:

- SAP

- Oracle Unifier

- EcoSys

- Power BI dashboards

Benefits

- Real-time data

- Single source of truth

- Executive-level visibility

14.4 BIM 5D and Earned Value Management

Advanced projects link:

- 4D BIM → Schedule

- 5D BIM → Cost

- EV → Physical model progress

This creates visual EVM dashboards, improving stakeholder understanding.

15. Common Earned Value Management Mistakes (and How to Fix Them)

Even experienced teams misuse EVM. Below are the most common construction-specific mistakes, with practical solutions.

Mistake 1: Treating EVM as an Accounting Exercise

Problem:

EV is calculated based on invoices instead of physical progress.

Solution:

Separate progress measurement from billing. EV must always represent earned scope.

Mistake 2: Poor Progress Measurement Methods

Problem:

Using subjective % complete without measurable criteria.

Solution Checklist

- ☐ Use quantity-based measurement

- ☐ Define milestones clearly

- ☐ Validate progress onsite

Mistake 3: Incorrect or Late Cost Data

Problem:

Actual costs are delayed or incomplete.

Solution:

Integrate site cost reporting with finance systems and enforce cut-off dates.

Mistake 4: Frequent Re-Baselining

Problem:

Baselines are changed to hide poor performance.

Solution:

Only re-baseline after:

- Approved scope change

- Contract variation

- Formal client approval

Mistake 5: Ignoring Trends

Problem:

Teams react to single-period CPI/SPI values.

Solution:

Focus on trend analysis, not isolated data points.

Mistake 6: No Action Thresholds

Problem:

Reports exist, but no corrective action is triggered.

Solution:

- CPI < 0.95 → cost recovery plan

- SPI < 0.90 → schedule mitigation

16. Case Study 1: High-Rise Residential Tower Project

Project Overview

- Location: Metro city

- Value: ₹450 crore

- Duration: 36 months

- Scope: 42-storey residential tower

Problem Identified

At Month 9:

- Project appeared “on budget”

- Client payments were regular

- Site reported good progress

EVM Analysis Revealed:

- CPI = 0.92

- SPI = 0.88

➡ Early signs of productivity loss and hidden delays

Corrective Actions Taken

- Re-sequencing of structural activities

- Introduction of additional formwork systems

- Productivity benchmarking per floor

Outcome

- Final CPI improved to 0.98

- Delay reduced from 4 months to 1.5 months

- ₹18 crore potential overrun avoided

17. Case Study 2: Highway Infrastructure Project

Project Overview

- Length: 68 km

- Contract type: EPC

- Value: ₹1,200 crore

- Duration: 30 months

EVM Setup

- WBS aligned with chainage

- Quantity-based EV measurement

- Weekly reporting cycle

EVM Findings

- SPI dropped below 0.85 during monsoon

- CPI remained stable at 1.02

Interpretation:

Schedule risk due to weather, not inefficiency.

Management Decision

- Approved time extension

- Avoided unnecessary acceleration costs

- Preserved contractor margin

Key Lesson

EVM helps differentiate controllable vs uncontrollable delays.

18. Case Study 3: Industrial Plant EPC Project

Project Overview

- Industry: Chemical processing

- Value: ₹900 crore

- Duration: 28 months

Challenge

Late engineering deliverables caused site delays.

EVM-Based Claim Support

- Engineering SPI = 0.78

- Construction CPI = 1.01

➡ Clear evidence of owner-caused delays

Outcome

- Successful EOT approval

- ₹45 crore prolongation claim supported using EVM data

PART 4: FAQs, Conclusion, Resources & Publishing Details

19. Frequently Asked Questions (FAQ) on Earned Value Management in Construction

Q1. Is Earned Value Management suitable for small construction projects?

Yes. While EVM originated in large government and EPC projects, it is highly adaptable. For small projects:

- Use simplified WBS structures

- Track EV monthly instead of weekly

- Apply EVM at major work-package level

Even basic CPI and SPI tracking provides early warning signals that traditional methods miss.

Q2. What is the difference between Earned Value and billing value?

This is a critical distinction.

- Earned Value (EV): Budgeted value of actual physical work completed

- Billing Value: Amount invoiced or certified

EV is independent of payment status. A project can earn value without being paid—and can be paid without earning value.

Q3. How accurate are EVM forecasts like EAC?

EAC accuracy depends on:

- Quality of baseline

- Accuracy of progress measurement

- Timeliness of cost data

Studies show EAC forecasts stabilize after 20–30% project completion and become increasingly reliable thereafter [4].

Q4. Can Earned Value Management be used for delay analysis?

Yes. EVM supports delay analysis by:

- Tracking schedule variance objectively

- Demonstrating productivity loss

- Supporting Extension of Time (EOT) claims

However, EVM does not replace CPM delay analysis—it complements it.

Q5. What SPI or CPI value should trigger management action?

Recommended thresholds in construction projects:

| Index | Threshold | Action |

|---|---|---|

| CPI | < 0.95 | Cost recovery plan |

| CPI | < 0.90 | Executive intervention |

| SPI | < 0.90 | Schedule mitigation |

| SPI | < 0.85 | Recovery / re-sequencing |

Q6. Is Earned Value Management mandatory in construction contracts?

Not always, but increasingly:

- Mandatory in government and public-sector projects

- Common in EPC, PMC, and funded infrastructure contracts

- Often required by lenders and investors

Even when not mandated, EVM provides a competitive advantage.

Q7. How does Earned Value integrate with Primavera P6?

Primavera P6:

- Uses activity-level budgets

- Automatically calculates EV, CPI, and SPI

- Allows baseline comparisons

Accuracy depends on correct progress entry and baseline discipline.

Q8. Can EVM be combined with BIM?

Yes. Advanced projects integrate:

- 4D BIM → Schedule

- 5D BIM → Cost

- EVM → Performance

This enables visual earned value dashboards, improving stakeholder understanding.

20. Conclusion: Key Takeaways and Call to Action

Earned Value Management in construction is not just a reporting framework—it is a project intelligence system. When implemented correctly, it transforms how projects are planned, monitored, and controlled.

This masterclass demonstrated that EVM:

- Integrates scope, cost, and schedule into one objective system

- Detects problems months earlier than traditional tracking

- Provides predictive forecasts, not reactive reports

- Strengthens claims, risk management, and executive decision-making

The most important lesson is that EVM success depends on discipline, not complexity. Well-defined WBS structures, measurable progress rules, timely cost capture, and trend-based analysis deliver far more value than complex software alone.

For construction professionals, mastering Earned Value Management is no longer optional. Owners expect transparency, contractors need margin protection, and project managers require early-warning systems to manage growing complexity and risk.

Action Steps for Your Project Team

- Review your current progress measurement methods

- Align WBS, BOQ, and schedule structures

- Introduce CPI and SPI trend monitoring

- Set clear thresholds for corrective action

Projects that adopt EVM proactively do not just avoid failure—they consistently outperform peers in cost certainty, schedule reliability, and stakeholder confidence.

21. Free Earned Value Management Resources

Famcod provides practical, construction-focused resources to support EVM implementation:

- Downloadable EVM Excel templates

- Construction progress measurement checklists

- Sample WBS and control account structures

- Primavera P6 EVM configuration guides

These resources help teams implement EVM without expensive consultants or complex systems.

22. Related Articles on Famcod

Explore these in-depth guides on Famcod.com to build a complete project controls skill set:

- Construction Planning and Scheduling Fundamentals

- Work Breakdown Structure (WBS) Best Practices

- Construction Cost Control Techniques Explained

- Primavera P6 for Construction Project Managers

- Construction Claims Management and EOT Analysis

- Project Risk Management in Construction Projects

- Cash Flow Forecasting for Construction Projects

(Internal links to be embedded contextually during publishing.)

23. Recommended Books & Courses (Affiliate Resources)

📘 Amazon Book Recommendations

🎓 Coursera Course Recommendations

- Coursera: “Construction Project Management”

Covers scheduling, cost control, and performance monitoring.